News and Events

-

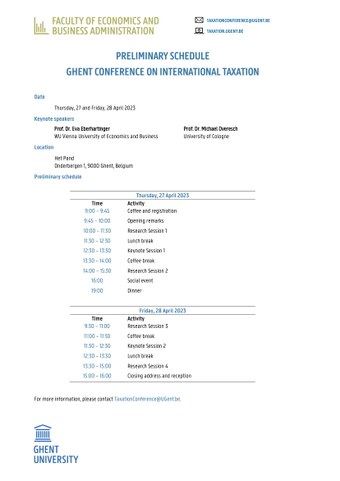

Ghent Conference on International Taxation - Program

We are pleased to inform you that the final program for the Ghent Conference on International Taxation (27-28 April) is now available.

You can find the schedule here.

-

Excursion parliament and meet & greet with the Minister of Finance

No less than thirty of our MBA students with taxation as their main subject voluntarily signed up for an extracurricular daytrip to Brussels, the heart of Belgian politics.The aim of this trip was to provide the students with more thorough insights into the interplay between taxation and politics. Thanks to all cooperating instances, we were able to offer the students a guided tour in the Belgian federal house of parliament in the morning and a meet and greet with Deputy Prime Minister and Minister of Finance Vincent Van Peteghem in the afternoon.

-

Vennootschapsbelasting toegepast 2023 (February 2023)

Auteur(s): Prof. dr. Em. Paul Beghin, Prof. dr. Annelies Roggeman, Prof. dr. Isabelle Verleyen

Vennootschapsbelasting toegepast benadert de materie van de vennootschapsbelasting gestructureerd en op een originele manier. De auteurs combineren het juridische uitgangspunt met interessante bedrijfseconomische inzichten. De band tussen het boekhoudrecht en het fiscaal recht wordt geïllustreerd met talloze voorbeelden en verwijzingen naar de rechtspraak.

Dit boek geeft een duidelijke schets van het toepassingsgebied van de vennootschapsbelasting, het bepalen van het belastbaar inkomen, aftrekbare en niet-aftrekbare beroepskosten. Voorts wordt uitgelegd hoe de belastbare grondslag wordt bepaald en hoe men de verschuldigde vennootschapsbelasting berekent. Tot slot wordt aandacht besteed aan de verrekening van voorheffingen en belastingkrediet, aan de verschillende tarieven en aan de bijzondere aanslagstelsels.

De combinatie van theorie en talrijke voorbeelden maakt dit handboek uitermate interessant als studieboek voor het hoger onderwijs en als referentiewerk voor praktijkmensen die geregeld in aanraking komen met de dagelijkse toepassing van de vennootschapsbelasting.

-

Registration open - Ghent Conference on International Taxation

We are pleased to inform you that the registration for the Ghent Conference on International Taxation (27-28 April) is now open. You can find the preliminary schedule attached to this message. Please click here to register before 20 April.

We like to remind you of the deadline for paper submissions. Please submit your full paper or extended abstract (3 to 5 pages) to TaxationConference@UGent.be in Word or PDF format by Monday, 16 January 2023. Notifications of acceptance will be sent out early March.

We are looking forward to welcoming you in Ghent!

Kind regards,

The organizing committee

-

Residential seminar 2022

On October 27 and 28, we organized the twelfth edition of our two-day Residential Seminar for the students Business Administration with Taxation as main subject. Armed with a suitcase full of tax knowledge, 46 tax students hit the road to Knokke at the Belgian coast. In addition to the students, we also welcomed many enthusiastic representatives from seven consulting firms (A. Coppin & Atacs, Deloitte, EY, Mazars, PwC, Titeca Pro Accountants & Experts and Vandelanotte) in Knokke.

Each of the seven participating firms drew up a realistic business case and subsequently supervised a team of 6 or 7 students working on their case. On the second day, the student teams presented their final result to a jury of Ghent University lecturers as well as experts from the field.

We look back on a successful edition for the students, the participating firms as well as for ourselves! On to next year!

The Taxation Research Group at the Faculty of Economics and Business Administration of Ghent University is proud to invite you to the first edition of the Ghent Conference on International Taxation, which will take place on 27 and 28 April 2023 in Ghent, Belgium.

The aim of this conference is to provide scholars working on international taxation research from a (business) economics point-of-view with the opportunity to share and discuss their recent work. Topics may include, but are not limited to: tax avoidance, reporting, compliance, transparency, harmonization, and managerial decisions.

Each presenter will receive individual comments on their research project from a discussant. Additionally, feedback will

be received from the attendees, keynote speakers, and organizers in a friendly atmosphere.Keynote speakers

We are happy to announce that our two keynote speakers for this edition will be:

Prof. Dr. Eva Eberhartinger

WU Vienna University of Economics and BusinessProf. Dr. Michael Overesch

University of CologneSubmission guidelines

Please submit your full paper or extended abstract (3 to 5 pages) to TaxationConference@UGent.be in Word or PDF format by Monday, 16 January 2023. Notifications of acceptance will be sent out in early March.Conference registration

The registration fee of €75 will cover all catering and social

events during the conference. More details regarding

registration will follow soon. Click here to receive updates.-

Research visit at Oxford University

Dr. Dave Goyvaerts will join the renowned Oxford University Centre for Business Taxation as a visiting researcher from September 2022.

In Oxford, he will carry out research on the OECD’s “Pillar 2” agreement to reduce international tax avoidance by introducing a global minimum corporate tax rate of 15 percent for large multinational firms. More specifically, he will study the impact of the new agreement on firm value.

The members of the Centre for Business Taxation are considered to be among the world’s foremost experts on this topic, having published several articles and hosted multiple events regarding the Pillar 2 proposal.

We wish Dave good luck!

-

Wetboek Accountancy en Fiscaliteit 2021-2022: Deel 1 en 2

Auteur(s): Prof. dr. Bertel De Groote, Luc De Meyere, Els De Wielemaker, Stijn Plas, Prof. Stefan Ruysschaert, Prof. dr. Annelies Roggeman, Prof. Jan Verhoeye

https://biblio.ugent.be/publication/8734647

-

New publication: An ex-ante assessment of the AGI : firm-level evidence from Belgian tax return data

Using confidential tax return data, we provide a unique research setting in which the Belgian notional interest deduction (NID) is replaced by the Allowance for Growth and Investment (AGI) as it is proposed by the European Commission. Our results show that the AGI would be a more viable option from a budgetary view. From a company view, however, introducing an AGI system would increase the probability of a higher effective tax rate (ETR). Especially large companies would be harmed as they would face a 7.6 percentage point higher probability of an ETR increase compared with SMEs. Furthermore, we find that there is a positive relationship between the equity ratio and the increased ETR, which is stronger for large firms compared to SMEs. This is in line with previous studies stating that large firms adjusted more aggressively to the NID by increasing their equity ratio more heavily than SMEs. However, large firms still face an ETR that is on average 10.4 percentage points lower compared with SMEs, indicating that the AGI is insufficient to undo the unequal level playing field between large and small companies.

P. Buyl, A. Roggeman, and I. Verleyen. (2021). An ex-ante assessment of the AGI: firm-level evidence from Belgian tax return data. CESIFO Economic Studies, 68(1),(2022), 46–72. DOI: http://dx.doi.org/10.1093/cesifo/ifab007

-

New publication: Political connections and tax avoidance : evidence from Belgium

This paper investigates to what extent politicians influence tax avoidance in Belgium. In order to examine this relationship, a unique dataset is constructed of all political mandates over the period 2004-2015. We find that Belgian companies with (former) politicians on their board of directors have a 3.64% points lower effective tax rate compared to unconnected counterparts. Also, firms having a higher number of politically connected directors or directors who have been active in politics for a longer period of time, face lower tax rates. Overall, our results suggest that companies consider politicians as valuable in applying a tax minimizing strategy.

L. Egghe, A. Roggeman, and I. Verleyen. Political connections and tax avoidance : evidence from Belgium. Accountancy & Bedrijfskunde, 2021(2), 20–31. DOI:http://hdl.handle.net/1854/LU-8722382

-

Doctoral Defence: The impact of thin capitalization rules

-

-

Doctoral Defence: The impact of corporate tax incentives for business: an analysis based on corporate tax returns

On 25/09/2020, Pieter Buyl was awarded the degree of doctorate after defending his PhD Thesis titled 'The impact of corporate tax incentives for business: an analysis based on corporate tax returns'. His promoters were Prof dr. Annelies Roggeman, Prof dr. Bertel De Groote en Antoine Doolaege.

-

New publication: The impact of thin capitalization rules on subsidiary financing : evidence from Belgium

In order to prevent excessive profit shifting using internal debt by multinational firms, several countries have introduced thin capitalization rules limiting the deductibility of interests on internal loans. While prior research has consistently found that firms affected by thin capitalization rules reduce their internal debt-to-equity ratio, the means through which this reduction is achieved are understudied. This paper employs a Comparative Interrupted Time Series methodology to identify the short-term effects of newly introduced thin capitalization rules on subsidiaries' financing preferences, using a new dataset of detailed firm-level accounting data. The results indicate a reduction in internal debt and an increase in equity for affected firms, both by an increase in paid-up capital and by an increase in retained earnings. These findings about the way firms react may help lawmakers to estimate impact of future tax regulations.

D. Goyvaerts and A. Roggeman. The impact of thin capitalization rules on subsidiary financing : evidence from Belgium. Economist - Netherlands. (2020). 168(1). p.23-51. DOI:http://dx.doi.org/10.1007/s10645-019-09353-x

-

New publication: What do politicians think of the common consolidated corporate tax base? A Belgian case study

This paper investigates to what extent politicians influence tax avoidance in Belgium. In order to examine this relationship, a unique dataset is constructed of all political mandates over the period 2004-2015. We find that Belgian companies with (former) politicians on their board of directors have a 3.64% points lower effective tax rate compared to unconnected counterparts. Also, firms having a higher number of politically connected directors or directors who have been active in politics for a longer period of time, face lower tax rates. Overall, our results suggest that companies consider politicians as valuable in applying a tax minimizing strategy.

A. Roggeman, P. Van Cauwenberge, I. Verleyen, and C. Carine. (2019). What do politicians think of the common consolidated corporate tax base? A Belgian case study. Accountancy & Bedrijfskunde, (1), 2–20.L. DOI:http://hdl.handle.net/1854/LU-8624428

-

New publication: Did the economic impact of a Common Consolidated Corporate Tax Base (CCCTB) affect the voting behaviour of the members of the European Parliament?

On 19 April 2012, the European Parliament voted on the European Commission's proposal for a Common Consolidated Corporate Tax Base (CCCTB) Directive. We exploit a unique research setting which was created by an economic impact assessment of CCCTB that was made available to the Members of the European Parliament (MEPs) to support their decision process. Using statistical regression analysis, we investigate if the voting behaviour of MEPs was influenced by the predicted economic impact of CCCTB on their specific country. Our results show that, even after controlling for party, country and individual variables, the economic impact indeed had a significant influence on the voting behaviour of MEPs. In particular, more favourable economic consequences of CCCTB for a country led to a higher chance for MEPs to vote in favour of the CCCTB proposal. To the best of our knowledge, this is the first study which empirically investigates the relationship between the voting behaviour of MEPs and the expected economic impact of measures they decide on.

I. Verleyen, A. Roggeman, and P. Van Cauwenberge, “Did the economic impact of a Common Consolidated Corporate Tax Base (CCCTB) affect the voting behaviour of the members of the European Parliament?,” Economist, vol. 163, no. 1, pp. 1–23, 2015. DOI:http://dx.doi.org/10.1007/s10645-014-9238-4

-

Doctoral Defence: Essays on the harmonization of the corporate tax system in Europe

On 03/09/2015, Isabelle Verleyen was awarded the degree of doctorate after defending her PhD Thesis titled 'Essays on the harmonization of the corporate tax system in Europe'. Her promoter was Prof. dr. Philippe Van Cauwenberge.

-

Doctoral Defence: Essays on the Common Consolidated Corporate Tax Base

On 05/03/2015, Annelies Roggeman was awarded the degree of doctorate after defending her PhD Thesis titled 'Essays on the Common Consolidated Corporate Tax Base'. Her promoter was Prof. dr. Philippe Van Cauwenberge.

-

New publication: Impact of a common corporate tax base on the effective tax burden in Belgium

In March 2011, the European Commission launched a proposal for a Common Consolidated Corporate Tax Base (CCCTB). However, a Common Corporate Tax Base (CCTB), leaving consolidation and apportionment out of consideration, appears to be a more realistic proposition for corporate tax harmonization in Europe. Using the European Tax Analyzer (ETA), we simulate the impact of the CCTB on the effective tax burden in Belgium. The results show that the adoption of the CCTB increases the Belgian effective tax burden by 16%. This remarkable increase is mainly driven by the fact that national tax deductions are not allowed under CCTB. This study allows policymakers to gain insight into the size effects of certain corporate tax measures and contributes to the current discussion on corporate tax harmonization in Europe.

A. Roggeman, I. Verleyen, P. Van Cauwenberge, and C. Coppens, (2014), “Impact of a common corporate tax base on the effective tax burden in Belgium,” Journal of Business Economics and Management, vol. 15, no. 3, pp. 530–543, 2014.DOI:http://hdl.handle.net/1854/LU-5672227

-

New publication: The EU apportionment formula: insights from a business case

In this paper we use firm level data from a listed multinational to investigate how several designs for the Common Consolidated Corporate Tax Base (CCCTB) formula could affect the allocation of the consolidated tax base. The design is relevant in the light of member states' concern for protecting their tax revenues, as well as for the multinational companies' tax minimizing possibilities. Moreover, it plays an important role in achieving an efficient and simple tax system. Simulating different apportionment formulas, the results show that including more factors and using more equal weights distributes the common tax base more equally, which could reduce the incentive to shift factors from high to low tax countries. The results also indicate that simplifying the factor definitions, leads to rather minor changes in the allocation. Using unpublished data, this study allows to investigate the consequences of different formulas in detail, which contributes to the current discussion on corporate tax harmonization in the EU.

A. Roggeman, I. Verleyen, P. Van Cauwenberge, and C. Coppens, (2013). “The EU apportionment formula: insights from a business case,” Journal of Business Economics and Management, vol. 14, no. 2, pp. 235–251, 2013.DOI:http://hdl.handle.net/1854/LU-2034523

-

New publication: An empirical investigation into the design of an EU apportionment formula related to profit generating factors

The European Commission (EC) has the intention to establish a Common Consolidated Corporate Tax Base, which requires an allocation formula to fairly distribute the consolidated tax base among all group entities. A fair distribution would mean that the allocation is closely related to the profit generating factors of the underlying entities. The EC supposes that fixed tangible assets, sales and labour are the dominant factors in the generation of profit. This paper analyses the profit generating capacity of these factors and of the alternative factor intangible assets. The results show that the proposed factors only explain 28% of the variation in profit. Moreover, the results indicate that recognized intangibles do not increase R2 significantly. However, for R&D intensive companies, adding the market less book value to proxy for unrecognized intangibles increases the explanatory power with 30%. This suggests that for these companies unrecognized intangibles could be important in generating profit.

A. Roggeman, I. Verleyen, P. Van Cauwenberge, and C. Coppens, (2012). “An empirical investigation into the design of an EU apportionment formula related to profit generating factors”, Transformations in Business & Economics, 11 (3) p.36-56. DOI:http://hdl.handle.net/1854/LU-3072922

-

New publication: Do SMEs face a higher tax burden? Evidence from Belgian tax return data

The public debate on taxation of domestic small and medium enterprises (SMEs) versus large and multinational enterprises (MNEs) is highly relevant nowadays. Using confidential tax return data instead of financial statement data, the results indicate that domestic SMEs face on average a 1.6 and 4.8 percentage-point higher effective tax burden compared to large domestic and large MNEs respectively. This suggests that tax incentives for SMEs are inadequate to compensate for the tax advantages of large and internationally operating companies. Furthermore, we show that the use of information built exclusively upon accounting data could bias the results.

P. Buyl and A. Roggeman, “Do SMEs face a higher tax burden? Evidence from Belgian tax return data,” Prague Economic Papers, vol. 28, no. 6, pp. 729–747, 2019. DOI:http://dx.doi.org/10.18267/j.pep.719