A Place of Greater Safety? The EU’s Clean Energy Security During the Clean Tech Race

By Mathieu Blondeel

[January 2023]

Dr Mathieu Blondeel is Assistant Professor at the Institute for Environmental Studies (IVM) of the VU Amsterdam. Before that, he obtained his PhD from the GIES and was a postdoc at the Warwick Business School.

A Change of Climate

At last week’s World Economic Forum, the head of the International Energy Agency (IEA), Fatih Birol, said that the main driver for the energy transition was now ‘energy security’, rather than climate change.[1] Energy security, indeed, has risen to the top of political agendas since the war in Ukraine and Russia directing its ‘gas weapon’ to the EU. One lesson learned from the conflict is how exposed the EU was to Russian energy sabotage in any shape or form.[2]

As a consequence, one of the main pillars of the REPowerEU plan is now to accelerate the clean energy transition. The plan is thus squarely embedded within a logic of optimising energy security. For example, the word ‘security’ is mentioned 23 times in the REPowerEU communication of May 2022, while the word ‘climate’ is only mentioned 11 times.[3]

This, of course, begs the question to what extent an EU energy system dominated by renewables and low-carbon technologies is that much more ‘secure’ than a fossil fuels-based one. Sure, we would be less exposed to geopolitical adversaries for our oil and gas supplies (because we would simply need less of them) yet the transition could, for example, just as easily create new dependencies for so-called critical minerals[a]. These rare earth elements and metals, such as lithium, cobalt, and copper, are crucial to manufacturing the low-carbon technologies that form the backbone of the transition.

And it is not just about the extraction of those minerals. They are part of global clean tech supply chains that also include refinement, processing, as well as eventual technology manufacturing. In all steps along these supply chains, a handful of countries may become dominant—and in some that is already the case. The impending competition for control over these supply chains is fast turning into a global clean tech race, where old geopolitical allies are pitted against each other.

This paper therefore takes a deep dive into the question of EU (clean) energy security while it seeks to accelerate the energy transition. The goal is not only to look at potential ‘upstream’ issues around control over mining minerals, but to take a holistic approach to understand the dynamics of clean energy supply chains as a whole and how clean energy security issues compare to fossil fuel security.

China’s Clean Supply Chain Dominance

The first time the issue of critical minerals came to the broader public’s attention was probably in the early 2010s.[4] In the aftermath of a collision between a Chinese trawler and the Japanese coast guard in the East China Sea in September 2010, China purportedly issued an embargo on the exports to Japan of rare earth elements (REEs); a group of 17 minerals primarily used in magnets that are essential for the production of, amongst others, wind turbines. In reality, however, China had already decided to scale back overall REE export prior to the incident in 2009, due to increased domestic demand. Immediately after export reductions, prices spiked by more than 10 times for many REEs.[5] At the time of the incident, China mined practically all REEs on the planet (97%). It prompted concern about these global supplies and led to efforts to reopen or develop new mines and to scale up REE recycling. By 2021 China’s share of global REE production had dropped to 60%.[6]

Two things stand out in this story, both of which are important to better grasp the clean energy security challenges the EU is facing. First, China had quietly but rapidly become the main producer of REEs, when, until the mid-1990s, the United States, was the world’s major producer. Figure 1 shows that, by now, China has come to dominate a number of these minerals’ supply chains, not just REEs.

Second, China’s dominance of mineral supply chains is not necessarily situated ‘upstream’ (at the extraction/mining level). Therefore, it is not just a matter of dumb geological luck but rather the result of effective industrial policy and careful planning. Consider China’s share of global REE production. As noted, it dropped from 97% to 60% over the years, yet its presence in the downstream operations—from processing to metals production to magnet-making—has continued apace, with the country holding some 90% market share across the value chain in 2019.

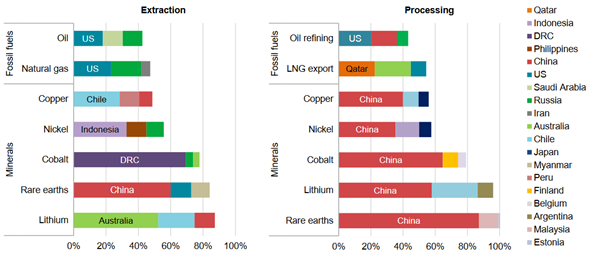

Figure 1: Concentration of selected critical mineral supply chains and fossil fuels by share of the top three producing countries in 2019[7]

Perhaps most shockingly, figure 1 shows that the control over the extraction and processing of some of these critical minerals is actually much more concentrated than for fossil fuels.

Moreover, the list of EU member states in figure 1 is limited, which highlights their exposure to emerging clean energy security challenges. Between now and 2040, overall demand for these minerals could go up at least sixfold in the IEA’s Net Zero by 2050 Scenario, with lithium demand multiplying by a factor of 42, followed by cobalt (x21), nickel (x19), and REEs (x7).[8]

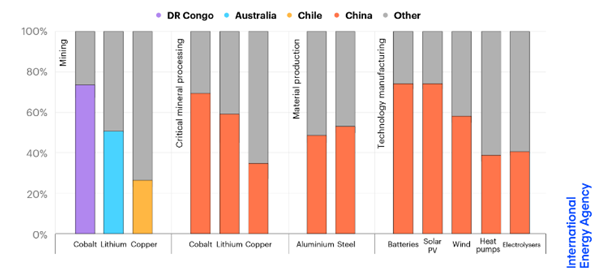

Figure 2 shows that further downstream, in wind, batteries, solar, electrolysers and heat pumps, the three largest producer countries account for close to three-quarters or more of manufacturing capacity for each technology – with China dominant in all of them. In electric vehicle (EV) batteries alone, China currently holds 75% of global production capacity.

Figure 2: Share of global production concentration of selected minerals and technologies[9]

Recent history has taught the EU not to put all eggs in one basket, may it be for fossil fuels or critical minerals. After all, in the case of (in)voluntary disruptions, one risks paying a hefty price. Fortunately for the EU and China’s other major geopolitical competitor, the United States, this supply chain dominance is not given and can be reversed. But how will the EU succeed in reversing these trends its facing?

How the EU wants to ensure clean energy security

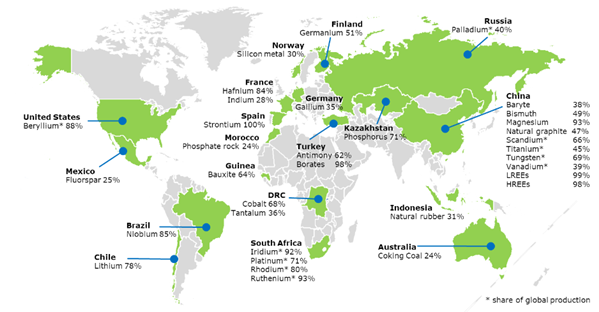

The EU had been working on the issue of clean energy security prior to the war in Ukraine. For example, since 2011, as part of its Raw Materials Initiative, the European Commission publishes a list, every three years of critical raw materials (primarily) used in clean technologies. The first list only contained 14 such materials, by 2020 the list had grown to 30.[10] Figure 3 shows the biggest minerals suppliers to the EU. Simultaneously with the launch of the 2020 list , the EU launched a European Raw Materials Alliance (ERMA) that includes industry stakeholders, trade unions, and civil society.[11] The goal is to secure access to critical and strategic minerals, advanced materials, and processing know-how for clean industries.

Figure 3: Share of mineral supplies to the EU[12]

In 2017, the EU also established a European Battery Alliance (EBA) including EU countries, industry, and the scientific community. The aim of the alliance is to develop an innovative, competitive and sustainable battery supply chain in Europe. For example, the EBA should enable up to 80% of Europe’s lithium demand being supplied from European sources by 2025.[13] A daunting task given that in 2020, 78% of its lithium was imported from Chile.

Under the REPowerEU plan, the Commission is preparing to secure (diversity of) critical mineral suppliers. The objective is to strengthen the European supply chain through the identification of mineral resources and of critical raw materials projects in the European strategic interest, all the while ensuring high levels of environmental protection. Indeed, in the past, the EU has been all too eager to outsource mineral mining to third countries where environmental and labour legislation is far less strict and there is less opportunity for the public to oppose mining projects.[14]

The key will be to integrate these, and other, separate packages into a comprehensive European green industrial strategy. The necessity of which has grown exponentially due to unprecedented policy decisions by what were previously considered geopolitical allies.

New Geopolitical Realities

The United States’ USD 370 billion Inflation Reduction Act (IRA), President Biden’s signature climate legislation package that was signed into law last year, offers massive subsidies and tax credits to companies investing in clean energy technologies such as batteries, EVs, solar panels and wind turbines – as long as the products and parts they manufacture are made domestically.[15]

The IRA should not only be seen as a climate package but as integral to the country’s national security strategy, primarily to minimise its exposure to China in certain strategic sectors. It has thus opened up a new era in geopolitics, one of a global clean tech race, in which old allies are rapidly becoming, if not foes, then at least competitors. Indeed, the United States risk luring EU-based companies away from a continent that is actively seeking to re-position itself in global clean tech supply chains.

In response, the Commission has already proposed a targeted and temporary relaxation of state aid rules and a common fund to protect the bloc’s clean tech industry.[16] It has also floated the idea of a ‘European Clean tech Act’ to provide funds to the industry. Member states are now due to discuss the IRA at a European Council in February. Our very own Belgian Prime Minister, Alexander De Croo, has also said that, “They are calling firms, in a very aggressive way, to say don’t invest in Europe, we have something better.”[17] Although consensus is growing that action is needed, the bloc remains divided on the exact response.

The EU also needs to consider that other countries are now emerging as frontrunners in this clean tech race, and they are not afraid of asserting their new-found geopolitical self-confidence. In October 2022, it was reported that Indonesia, the world’s largest nickel producer[b], was considering the establishment of an OPEC-like cartel for nickel and other key battery metals. The ‘lithium triangle’ of Chile, Argentina and Bolivia has previously floated the idea of a similar group to manage global supply and pricing of the (EV) battery metal.[18] In such a geopolitical context, re-shoring lithium mining under the EBA could be an important step to increase the EU’s clean energy security.

The differences between mineral and fossil fuel security

All in all, despite the important risks associated with an increased dependence on critical minerals as well as the many similarities with fossil fuel (primarily oil and gas) security concerns, it is crucial to consider their differences. The security concerns over the impact of, for example, oil and gas supply disruptions, import dependence, and price hikes are different when discussing the security of minerals. The brief comparison below between oil and mineral security highlights these important differences.

A first difference is the impact of supply disruptions, both in terms of magnitude and the affected actors. In energy, minerals are used as input for devices and infrastructure, while oil is mostly combusted on a continuous basis (an exception would be the oil that is used as petrochemical feedstock). When a supply crisis hits, consumers and households driving gasoline cars and diesel trucks are immediately faced with price increases and affected for as long as prices remain high.

By contrast, EV drivers’ daily lives are not affected at all. Electric vehicle manufacturers on the other hand do feel the consequences as they need lithium, cobalt and nickel to build EVs, while prospective buyers might also face higher prices. This could indeed slow EV uptake and extend dependence on conventional ICE (Internal Combustion Engine) vehicles but it can just as easily spark further technological innovation that help decrease materials intensity of battery backs, and thus costs.

Second, and this is a very simple one, oil can only be burned once. At the end of the infrastructure or device life cycle, minerals that form part of an EV battery can be recycled and re-used, thereby increasing the security of availability of these materials. The Commission’s March 2020 Circular Economy Action Plan is one of the main building blocks of the European Green Deal and should support efforts by the EBA to increase battery recycling. Promoting re-use and the circular economy, under the EU Green Deal, can be a means of creating greater resilience in supply chains.

Third, oil is difficult to replace rapidly when sudden prices hikes or supply disruptions occur. Minerals, on the contrary, are easier and faster to substitute. For example, although copper has the highest conductivity, when prices rose in the past, manufacturers sought to replace it with aluminium to curb rising costs. Moreover, continuous technological developments, will also reduce reliance on and demand for scarce minerals. For example, cobalt-free batteries are being developed, while copper, used in electric cabling because of its unparalleled conductivity[c], could be replaced by much lighter (yet less conductive) aluminium.[19]

Fourth, oil is a single commodity (notwithstanding its different grades), traded in a large and liquid global market. By contrast, many minerals are needed in the energy transition with each its own complexities and supply dynamics. They also have long and opaque supply chains. As opposed to oil, stockpiling minerals is simply insufficient to address the resulting more complex security challenges. Supply chains in their entirety should therefore be considered when designing security-minded supply strategies.

Concluding remarks

Driven by a realisation that its energy security was at stake, and even the political and economic stability of the bloc as a whole, the EU has been moving fast to become independent from Russian fossil fuels and to accelerate the energy transition. This paper has highlighted, however, that the transition to a renewables-based energy system does not automatically ensure energy security.

The EU is well aware that it needs to avoid the same mistakes that, in the past, have left it exposed to various forms of supply disruption from chokepoints, cartels, natural disasters, and geopolitics. It has launched a number of important legislative and policy initiatives (even prior to the war in Ukraine) to counter others becoming dominant and to improve its own strategic position in clean energy supply chains. Yet, as a clean tech race seems to be shaping up, the EU should be conscious that its clean energy interests do not necessarily align with those of its old allies.

A truly energy independent EU is impossible. It is simply not realistic to try to compete across all parts of clean energy supply chains. But with the right strategy and incentives for re-shoring of critical parts of these supply chains, the EU, through the energy transition could become a place of greater safety.

Footnotes

[a] Often also referred to as ‘critical (raw) materials’, especially in EU institutions terminology. These terms will be used interchangeably.

[b] Nickel is primarily used for corrosion resistance in industrial alloys and in lithium-ion batteries for EVs. Indonesia is responsible for 38% of refined nickel supply and holds a quarter of the world’s reserves.

[c] Conductivity refers to a material's ability to conduct an electric current.

Endnotes

[1] World Economic Forum, “Mastering New Energy Economics,” January 17, 2023, https://www.weforum.org/events/world-economic-forum-annual-meeting-2023/sessions/mastering-new-energy-economics.

[2] Thijs Van de Graaf, “Europe's Energy Crunch: No Time for Complacency,” December, 2022, https://www.ugent.be/ps/politiekewetenschappen/gies/en/research/publications/gies_papers/2023-global-energy-crisis/europes-energy-crunch-no-time-for-complacency.

[3] European Commission, “REPowerEU Plan,” May 18, 2022, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2022%3A230%3AFIN&qid=1653033742483.

[4] Gabriel Dominguez, “The complex road to ending the dependence on Chinese rare earths,” Japan Times, February 8, 2022, https://www.japantimes.co.jp/news/2022/02/08/world/china-rare-earth-dependence/.

[5] IEA, The Role of Critical Minerals in Clean Energy Transitions (Paris: IEA/OECD, May 2021).

[6] USGS, Mineral Commodities Summaries 2022- Rare Earths (Reston: United States Geological Survey, 2022).

[7] IEA, The Role of Critical Minerals in Clean Energy Transitions (Paris: IEA/OECD, May 2021).

[8] Ibid.

[9] IEA, Energy Technology Perspectives 2023 (Paris: IEA/OECD, January 2023).

[10] European Commission, “Critical Raw Materials Resilience: Charting a Path towards greater Security and Sustainability,” September 3, 2020, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52020DC0474.

[11] European Raw Materials Alliance, “About us,”, n.d., https://erma.eu/about-us/.

[12] European Commission, “Critical Raw Materials Resilience: Charting a Path towards greater Security and Sustainability,” September 3, 2020, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52020DC0474.

[13] European Battery Alliance, “Building a European battery industry,” https://www.eba250.com/about-eba250/.

[14] France24, “Europe joins the ‘white gold’ rush for lithium and faces an energy transition challenge,” October 19, 2022, https://www.france24.com/en/europe/20221019-europe-joins-the-white-gold-rush-for-lithium-and-faces-an-energy-transition-challenge.

[15] Sarah Jackson and Mary Hellmich, “The Inflation Reduction Act & The EU. The Need to Strengthen the Transatlantic Trade Relationship,” E3G, December 2022, https://e3g.wpenginepowered.com/wp-content/uploads/IRA-briefing.pdf.

[16] Politico, “Letter from European Commissioner Margrethe Vestager,” Politico, January 13, 2023, https://www.politico.eu/wp-content/uploads/2023/01/16/Letter_EVP_Vestager_to_Ministers__Economic_and_Financial_Affairs_Council__Competitiveness_Council_aressv398731.pdf

[17] John Henley and Jennifer Rankin, “Can EU anger at Biden’s ‘protectionist’ green deal translate into effective action?,” The Guardian, January 18, 2023, https://www.theguardian.com/world/2023/jan/18/eu-anger-biden-green-370bn-deal-action-industrial-policy

[18] Harry Dempsey and Mercedes Ruehl, “Indonesia considers Opec-style cartel for battery metals,” Financial Times, October 31, 2022, https://www.ft.com/content/0990f663-19ae-4744-828f-1bd659697468.

[19] Neil Hume and Henry Sanderson, “Copper boom: how clean energy is driving a commodities supercycle,” Financial Times, June 8, 2021, https://www.ft.com/content/40907aa6-354e-42f8-8d51-8cc01f0e9687.